Recurring payment is a payment model where customers authorize the business to pull funds from their accounts automatically at regular intervals for the goods and services provided to them on an ongoing basis.

With Pesapal's subscription based payments, customers can set automated card payments on their account where they can be debited automatically at a different set times. Examples of services one can enroll to include cable bills, cell phone bills, gym membership fees, utility bills and magazine subscriptions. These payments can be set to run an various intervals such as daily, weekly, monthly or yearly.

Enable our subscription based payments by passing an additional account_number field when sending data to our SubmitOrderRequest endpoint. This account_number should relate to an account number / invoice number that helps you identify the payment.

Note: It's critical that you get to understand all other Pesapal API 3.0 endpoints before implementing the recurring feature. Click here to get started.

In adition to the SubmitOrderRequest parameters, include one more param as show below.

| Parameter | Required | Description |

|---|---|---|

| account_number | Optional |

Customer's identification number know to your system. This can be an invoice number or an account number. |

{

"id": "AA1122-3344ZZ",

"currency": "KES",

"amount": 100.00,

"description": "Payment description goes here",

"callback_url": "https://www.myapplication.com/response-page",

"notification_id": "fe078e53-78da-4a83-aa89-e7ded5c456e6",

"billing_address": {

"email_address": "[email protected]",

"phone_number": "0723xxxxxx",

"country_code": "KE",

"first_name": "John",

"middle_name": "",

"last_name": "Doe",

"line_1": "Pesapal Limited",

"line_2": "",

"city": "",

"state": "",

"postal_code": "",

"zip_code": ""

},

"account_number": "555-678"

}

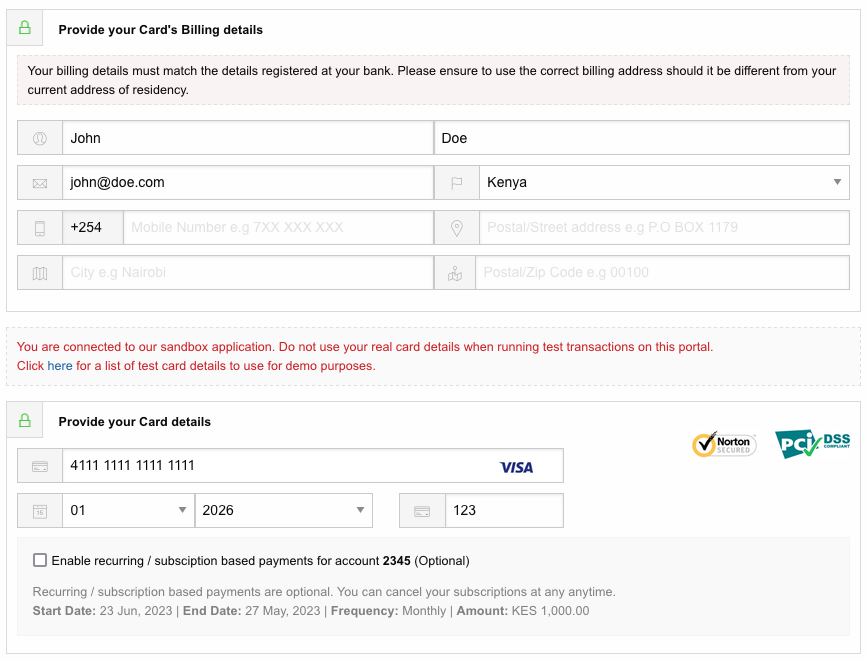

After successfully processing your request using the SubmitOrderRequest endpoint, the customer will be shown an option to opt into the recurring model on the Pesapal iframe during payment. The customer will then configure the frequency (Daily, weekly, monthly, quarterly or yearly), set a start and enddate, and finally enter an amount to be automatically deducted from their card on each payment cycle.

Once the customer has made a successful payment, Pesapal will automatically create a scheduled subscription on their behalf and an email alert will be sent to the provided card billing email that was used during the payment proccess, notifying them of the newly created subscription together with a link they can access a dashboard to manage their subscription.

Pesapal will NOT store the customer's card details. Instead, Pesapal has implemented the card tokenization technology.

Credit card tokenization is the process of de-identifying sensitive cardholder data by converting it to a string of randomly generated numbers called a "token." Similar to encryption, tokenization obfuscates the original data to render it unreadable to a user. Unlike encryption, however, credit card tokenization is irreversible.

Yes, in cases where your application already handles the process where the customer opts into a subscription based model from your application, Pesapal allows your to send these extra parameters via the API. This ensures that the user does not have to fill in the same details again (on your application and on the Pesapal Iframe).

However, it's important to note that the customer MUST accept to enroll to your subscription on the iframe. They will however not be able to edit the subscription details on the iframe.

In adition to the account_number parameter included in the SubmitOrderRequest, you are required to send the following parameter.

| Parameter | Required | Description |

|---|---|---|

| subscription_details | Optional |

Customer Subscription Object You can pass subscription data to Pesapal allowing a user to setup recurring payment.. |

| Name | Type | Required | Description |

|---|---|---|---|

| start_date | String | Mandatory |

Your subscription's start date in the format dd-MM-yyyy e.g 24-01-2023 representing 24th Jan 2023 |

| end_date | String | Mandatory |

Your subscription's end date in the format dd-MM-yyyy e.g 31-12-2023 represeting 31st Dec 2023 |

| frequency | String | Mandatory |

The period billed to the account is set out in the user contract. For instance, if users subscribe to a monthly service. Accepted values include DAILY, WEEKLY, MONTHLY or YEARLY |

{

"id": "AA1122-3344ZZ",

"currency": "KES",

"amount": 100.00,

"description": "Payment description goes here",

"callback_url": "https://www.myapplication.com/response-page",

"notification_id": "fe078e53-78da-4a83-aa89-e7ded5c456e6",

"billing_address": {

"email_address": "[email protected]",

"phone_number": "0723xxxxxx",

"country_code": "KE",

"first_name": "John",

"middle_name": "",

"last_name": "Doe",

"line_1": "Pesapal Limited",

"line_2": "",

"city": "",

"state": "",

"postal_code": "",

"zip_code": ""

},

"account_number": "555-678",

"subscription_details": {

"start_date": "24-01-2023",

"end_date": "31-12-2023",

"frequency": "DAILY"

}

}

After successfully processing your request using the SubmitOrderRequest endpoint, the customer will be shown an option to opt into the recurring model on the Pesapal iframe during payment. The iframe will this time load without he options to re-select the Frequecy, period and dates.

Yes, customers have the right to cancel their subscription at anytime. Pesapal will send them email alerts a day or two prior to charging their cards. This ensures customers are always aware of all upcoming charges giving them the freedom to opt out or pausing their subscriptions.

We currently support Visa and MasterCard for recurring payments. More card options will be enabled in the near future.

Once a schedule is created and executed successfully, Pesapal will trigger an IPN (Instant Payment Notification) to the IPN endpoint you provided when calling the SubmitOrderRequest endpoint. This IPN call will have the OrderNotificationTypei> set as RECURRING.

The IPN alert will either be a GET or POST request, depending on which HTTP method you selected when registering the IPN URL. Click here for more details on how to register your IPN endpoint.

The IPN call will have the following parameters;

| Parameter | Type | Description |

|---|---|---|

| OrderTrackingId | String | Unique order id generated by Pesapal. |

| OrderNotificationType | String | Value set as RECURRING to represent a Recurring IPN call. |

| OrderMerchantReference | String | Your account number received as part of the SUBMIT ORDER REQUEST. |

In addition to the normal payment status details received from the GetTransactionStatus endpoint, Pesapal will append an object subscription_transaction_info containing some additional recurring payment data

| Name | Description |

|---|---|

| account_reference | Customer's identification number know to your system. This can be an invoice number or an account number. |

| amount | Amount paid by the customer. |

| first_name | Customer's first name. |

| last_name | Customer's last name. |

| correlation_id | Pesapal's unique recurring payment identifier / id. |

{

"payment_method": "Visa",

"amount": 100,

"created_date": "2022-04-30T07:41:09.763",

"confirmation_code": "6513008693186320103009",

"payment_status_description": "Failed",

"description": "Unable to Authorize Transaction.Kindly contact your bank for assistance",

"message": "Request processed successfully",

"payment_account": "476173**0010",

"call_back_url": "https://test.com/?OrderTrackingId=7e6b62d9-883e-440f-a63e-e1105bbfadc3&OrderMerchantReference=555-678",

"status_code": 2,

"merchant_reference": "1515111111",

"payment_status_code": "",

"currency": "KES",

"subscription_transaction_info": {

"account_reference": "555-678",

"amount": 100,

"first_name": "John",

"last_name": "Doe",

"correlation_id": 111222

},

"error": {

"error_type": null,

"code": null,

"message": null,

"call_back_url": null

},

"status": "200"

}

Once you've fetched the recurring data, you are then required to store the same in your system and provide services / goods as subscribed.

Your IPN endpoint should then respond to Pesapal with a json string confirming service delivery. Part of the json string contains a status parameter that should be set as 200 (meaning request was received and processed) or 500 (meaning request was received but there was an issue providing the services).

Sample JSON Response String: {"orderNotificationType":"RECURRING","orderTrackingId":"d0fa69d6-f3cd-433b-858e-df86555b86c8","orderMerchantReference":"555-678","status":200}